Authored by Zinabu Ambisa

The review was mainly focused on to review

the production and marketing of banana in Ethiopia. Specifically aims to

review the overall status

of banana production, banana marketing and its constraints in the

Ethiopia. Dessert banana and plantain (Musa sp.) are the fourth most

important

staple food crops in the world after rice, wheat and maize. Currently

banana in Ethiopia covers about 59.64% (53,956.13 hectares) of the total

fruit

area, about 68% (478,251.04 ton) of the total fruit produced, and about

38.3% (2,574.035) of the total fruit producing farmers. On the other

hand,

about 68.72% (37,076.83 hectares) of land covered by banana, about

77.52% (370,784.17 ton) of the banana production, and 22.38% (1,504,207)

of

the banana producers in Ethiopia are found in the Southern Nations

Nationalities and Peoples Regional State (SNNPRS). Hence as we have

reviewed

several researches conducted by several authors are concentrated in the

southwestern part of the country in the Southern Nations, Nationalities

and

Peoples Regional State (SNNP) and Oromia Regional States this is due to

the authors select this area purposively depending on productions

potential.

So that it’s better if researches are conducted on other part of the

country. And also, several researches are conducted on banana marketing

but not

on production, again its better if researcher include its production in

their thesis.

Keywords: Banana; Constraint; Marketing; Production

Background and justification

Dessert banana and plantain (Musa sp.) are the fourth most

important staple food crops in the world after rice, wheat and maize

[1]. Dessert banana in particular is a commercially important crop

in the global trade, both by volume and value, as a leading fruit [1].

In 2010, world commerce in banana was valued at US 8.05 billion

and the total world production of banana is about 106,541,709.00

tons [FAOSTAT, 2012]. For many African, Asian and Latin American

countries, banana is as well one of the most important fruit for

foreign exchange earnings [FAOSTAT, 2012].

Dessert banana is also the major fruit crop that is most widely

grown and consumed in Ethiopia. It is cultivated in several parts

where the growing conditions are favorable. Especially in the south

and southwestern parts of the country, it is of great socioeconomic

importance contributing significantly to the overall wellbeing of the

rural communities including food security, income generation and

job creation [2].

Currently banana in Ethiopia covers about 59.64% (53,956.13

hectares) of the total fruit area, about 68% (478,251.04 ton) of the

total fruit produced, and about 38.3% (2,574.035) of the total fruit

producing farmers. On the other hand, about 68.72% (37,076.83

hectares) of land covered by banana, about 77.52% (370,784.17

ton) of the banana production, and 22.38% (1,504,207) of the

banana producers in Ethiopia are found in the Southern Nations

Nationalities and Peoples Regional State (SNNPRS) [25].

Gamo Gofa, Bench Maji, and Sheka zones are among the major

banana producing zones of the SNNPRS [3].

Objectives of the review

General objective:

• To review the production and marketing of banana in

Ethiopia.

Specific objectives:

• To review the overall status of banana production in the

Ethiopia.

• To review banana marketing and its constraints in the

Ethiopia.

Banana production in ethiopia

In Ethiopia, the modern banana production was started at the

beginning of this century with the establishment of the state farms

and different plantations such as large scale sugarcane plantations.

The production system of the crop is mainly composed of 1) small

plantations in home gardens owned by small farmers-especially

in the South-Western and Western provinces; 2) medium-sized

plantations of not more than 10 ha supplying local consumers; and

3) relatively large plantations above 20 ha developed to supply

export markets [4].

The export business of banana in Ethiopia dates back to

1961 where the country started at about 5000 tones. This figure,

however, increased to 60,000 tones by the year 1972 when the

country exported to different countries of Europe, Asia and Africa.

In 1975 the total production of banana in the country has reached

about 100,000 tones [5].

Banana in Ethiopia is produced by both small-scale farmers

and state farms. The production system is slightly different between

small-scale farmers and state farms.

Commonly farmers spacing between rows and plants ranges

from 3m to 3.5m and they do not practice the management of

suckers, even though recent trends show that some farmers have

started to manage number of suckers per hill due to yield reduction.

Use of commercial fertilizer on banana field is not practiced;

however, some farmers use animal dung and compost as organic

fertilizers. They practice weeding as deemed necessary. In most

of the major banana producing areas of the country, farmers use

supplementary furrow irrigation during the dry months. Banana

fields are maintained up until the time when yield starts declining

and then they shift to another land and establish new plantation. As

per the response of the farmers and experts, the sources of banana

suckers to establish plantation used to be nurseries of the Ministry

of Agriculture and state farms in places where there were state

farms. To date farmers use suckers from their own banana fields,

even though they can get suckers from the nurseries of the regional

Bureaus of Agriculture and Rural Development. On average, farmers

replant their banana plantations every 5 year.

Types of banana grown

Cultivated bananas are derived from two species of the genus

Musa, namely from Musa acuminate and Musa balbisiana. Musa

acuminate originates from Malaysia, while Musa balbisiana

originates from India. African banana is grouped into three

categories, including East African (mainly dessert) bananas, the

African plantain banana grown mainly in Central and West Africa,

and the East African Highland banana, used for cooking and beer

preparation [6].

In Ethiopia, even though both dessert and cooking types/

varieties of banana are released by the research system, the types of

varieties that are under production are dessert type that has been

under production since the early 1970s. In major banana producing

areas, farmers produce formerly recommended varieties such as

Dwarf Cavendish, Giant Cavendish, and Poyo. Most of them produce

Dwarf and Giant.

They produce these varieties for market. Dwarf has short plant

height, which is easy to manage, while Giant and Poyo have good

fruit size and quality for market. Some farmers also grow Ducasse

Hybrid variety, East African Highland Cooking banana, which

is used as windbreak and tolerant to stresses such as drought.

Ducasse hybrid is starchy type and is not preferred as dessert, but

other African countries use it for brewing.

In general Table 1 summarizes the banana varieties that have

been released by the Ethiopian Institute of Agricultural Research

(EIAR). There are also different local varieties that are produced

in almost all part of the country by small-scale farmers as garden

crop mainly for home consumption and in some cases for sale in

local markets.

Table 1: Type of banana varieties released.

Production zones

Overall, banana is mainly produced in the southwestern part

of the country in the Southern Nations, Nationalities and Peoples

Regional State (SNNP) and Oromiya Regional States. The specific

major banana production area in the country is Arba Minch area

with about 2500 hectares of banana plantation and the second major

production area are in the southwestern part of the country around

Jimma, Sheka, Kaffa, and Bench Maji zones in Southern and Oromiya

regional states. Banana production in Amhara, Tigray, Benishangul-

Gumuz, and Gambella is mainly for domestic production under very

traditional system as a garden crop. However, due to the promotion

of different irrigation systems, which is linked with the production

of fruits and vegetable all over the country, banana production in

the stated regions including in Afar and Somali Regional States is

coming into picture. The Afar and Somali Regional State do have

huge potential for the production of banana due to the availability

of rivers for irrigation like Awash River in Afar and Wabishebele in

Somali Region.

Gamo Gofa Zone in SNNP and West Wollega zone in Oromiya are

the major producing zones (Figure 1). When comparing the wereda

level with zonal distribution, there is considerable variability in the

allocation of land among weredas in a given zone. This is mainly

due to the fact that banana in the country is mainly produced using

supplementary irrigation. Even though, a given wereda is suitable

for banana production, it may not produce due lack of access to

irrigation.

Kathirvel N [7] analyzed the economic factors limiting to

banana production with the help of Garrett Ranking technique. He

pointed out that credit inadequacy was the major problem (rank

1) in the production of banana. High fertilizer cost was the next

important problem (rank 2). The small size of farm holdings, the

lack of technical guidance was the least important problems.

Joel Mpawenimana [8] in his study analyzed the socio-economic

factors influencing the production of bananas in Kanama district in

Rwanda. After estimating the relationship between the output of

bananas and various socio-economic factors, the findings showed

that various socio-economic factors have to be reviewed in order

to improve the production of bananas in the country. The results

described that land, physical capital, fertilizer and price, have

positive relationship with the banana output.

Several studies have identified the determinants of yield

for banana production. Apart from inputs of production, other

factors have influenced yield levels. Yamano, T: 2015 examined the

integration of dairy and banana farms in Uganda and the effects of

selected determinants on banana yield. Results of the study revealed

that the amount of organic matter, plot size, tenancy, number of male household members, farm assets, land altitude, population

density, and rainfall were statistically significant predictors of

banana productions.

Banana Production trends

Based on the production estimates for 2002 production season

about 24 thousand hectares of farmland was allocated for banana

nationally with considerable variation among regions. Based on

the level of banana production, SNNP Region ranks first followed

by Oromiya, Amhara, and Benishangul-Gumuz. However, based on

the proportion of farmers involved in banana production, Gambella

region ranks first where about 31% of the farm households

are involved in banana production, followed by SNNP (28%),

Benishangul-Gumuz (19%), Oromiya (16%), and Afar 11%) with

about 14% of farmers growing banana at national level (Table 2 &

3).

Consumption

Unlike other East African countries, banana is consumed only

in the form of fresh in Ethiopia. This is mainly because the type

of banana produced in the country is dessert type and there is no

tradition to use it in different form. Rather, false banana, which is

mainly produced in the SNNP regional state, is the major source of

energy food. The traditional dishes produced from false banana are

Bulla and Kocho. The expansion of the food industry in the urban

areas and the increased demand for processed foods especially for

children is expected to create demand for banana processing.

Analyses of the supply chain of banana

The overall supply chain of banana in Ethiopia can be broadly

divided into two chains, the first being the chain from the major

production area to the terminal market (Atkilt Tera) and the second

the chain that starts from the banana producers as garden crop to

the local rural or wereda markets.

The entire supply of banana to the terminal market comes from

Gamo Gofa Zone. The supply of banana from the Zone is from three

sources: the state farm, farmers’ fruit and vegetable marketing

union and individual farmers. The land allocated by the state farm

is about 285 ha, by members of marketing cooperatives is about

500 ha and more than 2000 ha of land by individual farmers. This

shows that individual farmers still dominate in the production of

banana.

Small-scale producers: Small-scale banana producers are

found almost in all parts of the country where banana can be

produced. In general, small-scale farmers can be categorized into

two groups. The first category of farmers is those who produce

banana as one of their major production activities and the second

category are those who produce banana as garden crop mainly for

home consumption. They usually produce in small amount mainly

for domestic consumption and if surplus for sale in local markets.

Purchasers usually are local consumers and local retailers. Such

producers transport banana using locally made bamboo baskets

either at the back of women or at using pack animal. Due to the recent

government intervention in promoting group marketing through

marketing cooperatives, there are farmers who are members of

such cooperatives in the major banana production areas. However,

dominant part of the marketed surplus (62%) comes from farmers

who are not members of marketing cooperatives.

State farms: The role of state farms in the country has been

diminishing since 1990s following the privatization process. There were

two state farms producing banana, however, due to disease

one of the farms had abandoned banana production.

Upper awash agro-industry enterprise: This is a state owned

enterprise with three major farms and Awara Melka state farm is

the one with banana plantation. However, recently the plantation is

abandoned due to the deterioration of fruit size and quality because

of a severe nematode infestation and the banana plantation is

replaced by sugar cane plantation.

North omo agricultural development enterprise: This is

also a state owned enterprise with two farms i.e. Arba Minch state

farm and Sille State Farm, which are the major supplier of banana

to ETFRUIT. Overall land size allocated to banana in both farms at

present is 285 ha. There is a plan to increase this to 400 ha. The

supply of banana is more or less stable over a year with some

fluctuation (Figure 2 & 3).

Market structure of banana

Market structure analysis covers other market actors outside

of farming households such as importers/ exporters, wholesalers,

retailers, assembler/ collectors, transporters and laborers [9].

Market concentration: According to Tomek, et al. [10],

concentration ratio refers to the number, and relative size of buyers

in the market. The structure performance hypothesis states that the

degree of market concentration is inversely related to the degree of

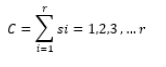

competition [11]. The concentration ratio is given as:

Where, C = concentration ratio,

Si = the percentage market share of the ith firm,

r = the number of relatively larger firms for which the ratio is

going to be calculated.

Concentration ratio of 50% or more is an indication of a strongly

oligopolistic industry, 33-50% a weak oligopoly and less than that a

competitive industry [12].

Market concentration measure: According to Getahun Kassa,

et al. [13], the concentration ratio of the biggest four firms were

considered to determine the structure of the market. 40 traders

in each specific fruit type were interviewed to understand the

structure in the market (Table 4).

Table 4: Type of banana varieties released.

The table is the results of the research done by [13], so the

CR4 for banana was 86.76 percent which indicated that the market

structure for banana was strong oligopoly.

According to Severova, et al. [14], oligopoly can be defined as

a market model of the imperfect competition type, assuming the

existence of only a few companies in a sector or industry, from

which at least some have a significant market share and can

therefore affect the production prices in the market. Therefore,

a strong oligopoly market structure for banana implies that the

concentration of market power on few big wholesalers.

Market conduct: Meijer [15] said that, “conduct is pattern of

behavior which enterprises follow in adopting or adjusting to the

market in which they sell or buy”, in other words the strategies of

the actors operating in the market.

Market conduct investigates the behaviors and rules that

regulate the relationships between actors or how they engage with

one another [9].

According to Getahun Kassa, et al. [13] Market conduct indicated

components like level of competition, the accepted standards in the

market, transparency of transactions and terms of payment.

a. Price Setting mechanisms: Fruit products (banana) are

easily perishable by their very nature. Once the status of

the fruit products reached maturity level, the producer’s

power to influence price is insignificant. In the study

area, due to the existence of too many producers and few

numbers of traders, producers were price takers.

Ayelech [16] reported that farmers do not negotiate on price

to sell their produce; indicating this large number of producers are

price takers.

b. Standard setting in the market: The existence of few

numbers of traders in the market also gave a significant

power for traders to set the standards of the fruit products.

Most of the time, a good quality banana fruit product is

determined by visual observations. After harvesting, the

trader can reject the offer by the producer if the trader

believed that it is a poor quality product; or low price will

be offered to the producer for poor product quality. The

lack of additional premium for good quality fruit products

discouraged farmers from performing activities which

can enhance product quality. Furthermore, constant price

offered for fruit products irrespective of quality made

farmers subservient to the needs of traders and agents

[13].

c. Sources and transparency of information: Clear market

information is highly crucial to create transparency

and efficiency in the banana fruit markets. Imperfect

information is one of the causes for imperfect market.

There is no formal source of information for producers

regarding pricing and overall market situation in the

country. Most producers relied on informal sources of

information obtained from neighbors, brokers and

traders. Regarding information transparency, there is

no perfect exchange of information between producers

and traders about product price in terminal markets.

Therefore, in the absence of timely and reliable market

information, market fails to bring economic efficiency

[13].

Nega, et al. [17] reported that the majority of fruit producers

lack adequate, timely and reliable market information in the study

area.

d. Terms of trade: There was no formalized or regulated

system in which effective exchange could take place

between producers and traders. Regarding terms of

payment, there was irregularity. Most of the time an

exchange was being made on cash basis, but there were

some room for post payment. More than 90 percent

of producers practiced cash in hand system. On the

contrary, all local traders stated that they received post payment. This implies that a deferral payment method

was practiced between local traders and big city traders.

The lack of formal and regulated trading system between

actors in the chain typifies traditional marketing system

where exchange took place based on trust and good social

relationship. Since there is no legally binding agreement

between actors in the chain, experiencing defraud is very

common while entering into a new market [13].

Adugna [18] & Nega, et al. [17] found that large proportion

of the fruit producers practiced cash in hand system and take the

price as soon as they sell the fruits.

e. Market performance (Marketing margin) of banana:

Market performance is concerned with the benefits an

industry generates for its different stakeholders [19].

Measures of market performance reveal whether there

is market power in an industry [20]. To evaluate market

performance marketing margins analysis and sales

volumes were analyzed. The total marketing margin is

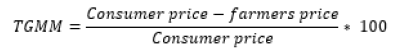

given by the formula shown below:

Where TGMM – Total gross marketing margin

Computing the total gross marketing margin (TGMM) is always

related to the final price paid by the end buyer and is expressed as

a percentage [21]. Wider marketing margin indicates high price to

consumers and low price to producers and it is an indicator of the

existence of imperfect markets [22]. The producers’ margin (which

is the portion of the price paid by the consumer that goes to the

producer) is calculated as:

GMMp = 1 - TGMM

Where: GMMp is producers’ share in consumer price.

The above equation tells us that a higher marketing margin

diminishes producers’ share and vice versa. It also provides an

indication of welfare distribution among production and marketing

agents.

Market performance refers to the impact of structure and

conduct as measured in terms variables such as prices, marketing

margins, and volume of output.

f. Performance of banana market chain: The performance

of banana market chain was calculated by taking common

market catchment for all traders. This happened because

of its accessibility to all local traders as compared to other

market catchment.

According to Getahun Kassa, et al. [13] in bench Maji Zone south

west Ethiopia, in terms of TGMM, total gross marketing margin in

channel II and channel IV were 83.33 percent for each respective

channel. TGMM in channel III was 85.33 percent. Channel I

accounted for 60 percent of TGMM. According to Cramer, et al. [22],

wider marketing margins in all channels were good indicators of

the existence of imperfect markets for banana.

In the final price for the different channels of the banana

marketing system, producers captured 16.67 percent of the final

price in channel II linking producers and wholesalers through

brokers; followed by 16.67 percent in channel IV linking producers

directly to wholesalers.14.67 percent of the final price was captured

in channel III where producers and wholesalers linked through

collectors. The highest producers’ share was 40 percent in channel

I where banana flowed from producers to local consumers through

farmer traders. High TGMM diminished the share of producer’s in

final price.

In terms of carrying large volumes of banana, 89.48 percent of

sales volumes accounted for channel III, followed by 8.21 percent for

channel IV, 2.31 percent for channel II, and the remaining 0.001%

of sales volumes accounted for farmer traders. This implies that

channel III is more efficient in terms of distributing large volumes

of sales. The result revealed that wholesalers preferred to be linked

with producers through Collectors’ cooperatives (channel III).

Collectors’ cooperatives’ knowledge of the locality made this

channel highly preferable for wholesalers in providing information

about marketable products which in turn saved wholesalers’ time

(Table 5).

Challenges of fruits (banana) marketing

a. Seasonality: Seasonality is another factor affecting

banana marketing. As seasonal price fluctuation is the

major problem in banana’s marketing [13]. During

peak supply period, price declined. In peak seasons, the

perishability of the products does not give enough time

for producers to look for alternative market opportunities.

Thus, producers accept low price offered in peak seasons

to avoid massive loss of profits.

Getahun Kassa, et al. [13] demonstrated that price declined

by more than 15 percent in peak seasons. This implies that when

there is excess supply of fruits, price declines. Therefore, seasonal

price fluctuation is common implying that supply and price moves

in opposite direction.

b. Few numbers of big traders: The existence of many

producers but very few big traders which in turn lead

to large volumes of outputs produce must be absorbed

by high demand in big cities. Research indicates that

limited access to market is among the challenges of

banana marketing in the country. The participation of

big traders in the fruits industries is highly important in

bringing better opportunity for producers. However, the

existence of few big traders in the fruits industries limited

producers’ access to more efficient market channel [13].

c. Lack of organized market center: Getahun Kassa, et

al. [13] revealed that lack of organized market center is

one of the basic problems for the existence of imperfect

competition. Getting better incentives in terminal

markets depend on the quality of the produce to be

offered in those markets. However, due to absence of

market center in which good product quality is inspected

and standardized, producers and traders failed to receive

their fair share from the market in big cities.

d. Brokers’ interference: The main role of brokers/ agents

in the fruits (banana) markets is providing information

about price and output both for producers and traders. As

a result, they are considered as the most reliable partners

for traders in making deals with producers. Brokers

created collusion in the fruit’s markets in terms of

geographic dispersion to avoid unnecessary competition.

This collusion helped them to monopolize a certain

geographic area. So, without brokers, it is hardly possible

to create direct link between producers and traders.

We have tried to conclude our review: Dessert banana is

the major fruit crop that is most widely grown and consumed

in Ethiopia [23-25]. It is cultivated in several parts where the

growing conditions are favorable. Especially in the south and

southwestern parts of the country, it is of great socioeconomic

importance contributing significantly to the overall wellbeing of

the rural communities including food security, income generation

and job creation. Banana market channel linked producers to local

consumers through farmer traders. The structure of banana market

at each market level depends on the level of competition existing

in the banana market, the market concentration ratio was used as

evaluation criteria. Banana market performance is evaluated based

on the level of marketing margins by taking into consideration

associated marketing costs for key marketing channels.

The high the market concentration ratio indicates oligopoly

market structure. The existence of few big-traders in the market

gave market power for traders in deciding output price and setting

product quality standard [26,27]. The TGMM indicates that the

markets for banana were imperfect markets. However, the most

efficient banana market channel in the area was the one that

links producers to wholesalers through Collectors’ cooperatives.

Collectors’ cooperatives good knowledge of the locality made this

channel a preferable channel to distribute large volumes of banana

products to terminal markets in big cities. However, seasonal

price fluctuation, the existence of few big traders, limited access

to information, lack of organized market center, and brokers’

interference mainly affected the performance of banana fruit

market in the country.

Hence as we have reviewed several researches conducted by

several authors are concentrated in the southwestern part of the

country in the Southern Nations, Nationalities and Peoples Regional

State (SNNP) and Oromia Regional States this is due to the authors

select this area purposively depending on productions potential.

So that it’s better if researches are conducted on other part of the

country. And also, several researches are conducted on banana marketing but not on production, again its better if researcher

include its production in their thesis.

To read more about this article....Open access Journal of Agriculture and Soil Science

Please follow the URL to access more information about this article

To know more about our Journals....Iris Publishers

To know about Open Access publisher

No comments:

Post a Comment